Are you Struggling to trade the Rangebound Markets and Avoid trading them Completely?

If you are a a trader, then you already understands easy it’s to trade and make money in the trending market.

But the market doesn’t ALWAYS trend, and after a nice trending move it enters into a Rangebound Trend where it trades between a high and low for quite a period of time before again resuming its trending move.

You wonder how to trade these Rangebound markets because you’re not sure when it’ll begin to trend again. So you try to avoid trading these Rangebound markets for some time.

And to your surprise, the market resumes its trend after spending some time in the Rangebound market. When it resumes its trendy move, you’re not sure how to trade it because there is also a possibility of price reversing back again to a Rangebound trend.

You don’t want to lose money during this Rangebound market, yet at the same time, it’s also difficult to know when the price will move out of Rangebound to trending mode.

So, Wouldn’t be nice if you had a system in your hand, to know where exactly the market moves from Rangebound to trending mode so that you are confident enough to trade it once the trending move begins?

Introducing – The RangeBound Trends – A system that will help you to trade the Rangebound market with confidence

You no longer have to worry about how to trade the Rangebound market because I’ve worked and developed a system to trade these Rangebound markets, which can be used in any timeframe.

The beauty of this system is that it lets you know where exactly the price has moved out of its Rangebound market – and NOW one can expect it to begin to trend so that you can trade it. You don’t need to know about any of Gann’s teachings or any other method to use this system.

This system is a standalone system and can be used on any instrument, be it stock/futures/commodity.

Like all other trading methods, this, too, will give a few losing trades here and there. But you get to win most of the time if applied Consistently over a period of time.

You not only stay relaxed once you understand this system, but you’ll also know when to resume your trading once the price comes out of the Rangebound market.

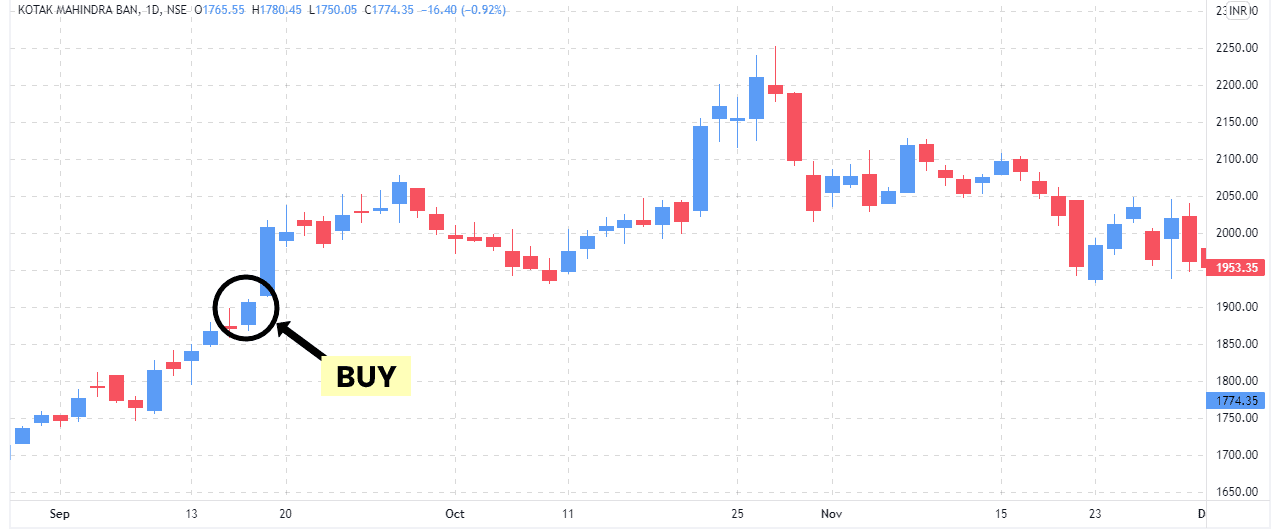

Once You Learn The Rangebound Trends Method, You’ll be able to Identify Opportunities and Potential Reversals in Trends, as Shown in the Charts Below.

“I was losing most of the Profits I was making because of Rangebound markets until I took this course”!

I am already a profitable trader, but I always lose most of my profits when markets start trading in a range. It was painful, but I found the perfect solution to beat the ranging price trends.

Divesh’s course taught me to find a near-perfect breakout point that marks the end of the Rangebound phase. I also learned to apply the same technique to other price patterns.

So now it’s a win-win situation.

Because now, I’m not only saving my earlier profits. But now, I also take the new trades when the price signals the breakout as per the method.

I highly recommend Divesh’s Rangebound Trends course because, most of the time market trades in a range. So, it is a must-have trading tool.

– K.Thakur

What Will You Learn With this Course?

How to trade when the Price enters into the Rangebound trend (phase)?

How does it work in day trading (5-minute timeframe) and swing trading (Daily timeframe)?

How to use this system even if you don’t know about other Gann’s methods?

Over 40+ example charts to help you to understand the concept well.

Traders with small trading capital (around 1-2 Lakhs) can use this system.

Here are a few Intraday Chart Examples of The Rangebound Trends Course.

“I was hesitant to buy Divesh’s Rangebound Trends course because I wasn’t sure if it would be worth it!”

I thought a lot before joining this course, as I didn’t want to invest my hard-earned money on something that wasn’t worth it.!

Before purchasing the course, I didn’t believe there was a method that could help me trade the ranging markets like a pro.

But Divesh’s course proved me wrong! And after joining the course, I found.

Divesh was 100% right. He has a method that really helps to trade the Rangebound market trends like a pro.

The method taught in the book (course) is simple, powerful, and easy to use. And honestly, I’ve not seen such a unique and accurate way to analyze the ranging market trends.

I highly recommend this course to every trader who wants to profit from rangebound market trends. I bet you won’t be disappointed because Divesh’s method is so accurate that my 10 out of 9 trades end up in profit.

– S.Mudaliar

Frequently Asked Questions

Yes, the concepts explained in this document are easy to learn. It can be used by traders, regardless of their background experience in trading.

There is no need to have any specific software.

As long as you have access to any trading software or to any websites from which you can access charts, then you can use it. You can even print out the chart and still be able to use the knowledge on the printed chart.

It’s a huge myth, and it’s totally wrong. You don’t need to have any knowledge of astrology. All you need is a chart, and use it the way our course material suggests.

These concepts are based on ‘Natural Universal laws’ and ‘Mathematics’. And they will continue to work forever.

It’s like 1+1=2. Will this equation change after 20, 30 or even after 50 years?

No, because it’s based on mathematics. And math can’t go wrong. It’s the same with all the methods which we teach here. They can be learned once and can be used forever.

No, the course content explained will work on all charts – be it stocks, futures, currency, or commodities. And it can be used on all time frames ranging from 5-minute charts to 1-month charts.

We have students from different trading backgrounds. Some of our students are day traders, and some of them are swing traders.

Some trade stocks, some trade futures, and some trade commodities. But our concepts/methods can be applied on any chart and in any timeframe, regardless of your trading style.

You can read the contents of the course in a couple of hours.

But after reading, I suggest you practice them on charts for a minimum of 3-6 months (or more) until you get a solid grasp of the concept. Once you are confident, then you can start taking real trades.

The success percentage of the method is good.

But there is no direct answer, like 80% or 90%.

It’s the trader’s responsibility to take all the trades whenever there is a signal. And also to have an understanding of the probabilistic nature of trading – where we are looking to profit from a series of trades.

For example, the first three trades might end up in small losses, and the fourth/fifth trade might be a big winner.

But what if the person doesn’t take the fourth and fifth trades due to fear? And then people start to blame the concept/method rather than trying to understand the game of trading which is to take all the trades as given by their method.

I suggest students understand the concept well enough and take a minimum of 50-100 trades (or even more if required) whenever there is a signal. This will help you shift your focus from worrying about the success percentage of the method to profiting from a series of trades perspective.

There are 2 reasons.

First, your GOAL is to become a professional trader: I know many people who try out “trading” without putting in serious work. And no wonder they lose their money in a short amount of time and quit trading completely. Our courses are not designed for these people.

The intention behind these courses is to really make you a professional trader – who is serious about putting in the time, money, and effort. If you approach trading from this angle – to become a professional trader, then these course prices are relatively moderate and accessible.

People spend a couple of lakhs in engineering, medicine, etc., because they are highly aware of the benefits that they’re going to reap later.

It’s the same with trading as well. If you invest in the right source, a few years down the line, you’ll be able to reap the rewards and you’ll be happy that you took the decision for yourself.

Second, Course prices might increase in the future: The price of our courses might increase in the future due to their uniqueness and the limited copies we sell each year (we sell only #5 copies of this course in a year). So you might consider investing now, then waiting for the future.

We don’t offer any money-back guarantee.

But we guarantee 100% satisfaction with trading knowledge through our courses, which you cannot find elsewhere, either online or offline.

This alone gives you a unique advantage over other traders and separates you from the crowd.

If you have any questions/doubts regarding the content of the course, you can email me through www.transfernow.net (it’s free), and I’ll reply to your question within 24-48 hrs.

Even after a couple of emails, if you are still not comfortable, then I’ll arrange a one-to-one session with you to solve your query and make you comfortable with the concepts.

I won’t leave you alone after your purchase – it’s my responsibility to ensure that your questions are resolved and you are clearer with the concepts/methods.

This is also one of the reasons why we sell limited copies (#5 copies per year) so that we can give complete attention to student’s questions and help them out.

The support from my end is valid for One-Year from the course delivery date.

The support system is strictly via email (through www.transfernow.net), and we don’t have any social media platforms for discussion.

What’s Unique About This Course?

This book is of 40+ pages.

It’s designed to impart a skill without giving too much information. There are 40+ charts that explain the concept in-depth, and it really helps you to understand it well.

Once you practice the concept discussed in this book for a few months, you’ll be able to acquire the skill of trading the Rangebound market with confidence.

How do I Buy this Course?

Please note that when you decide to buy any of our courses, you’ve to sign a Non-Disclosure Agreement contract with us to not share the contents of this course with anyone in any way/any means.

We give access to our courses only to people who sign this agreement with us. If you are not interested in signing a Non-Disclosure Agreement contract, please do not consider investing in our courses.

We sell only #5 copies per year of this course.

Our intention is not to cater to the masses. But to sell it to a few people who want to really understand the nature and truth of the market.

Here are the steps involved in purchasing this course

Below is the sequence of steps that you’ve to go through to purchase this course.

Step 1: Send an email to [email protected] – expressing your interest in purchasing this course.

Step 2: You will receive a KYC form and Non-Disclosure Agreement contract from our end, which you have to fill out and send back via email.

Step 3: Once we receive the signed copy of the KYC form and Non-Disclosure Agreement Contract, you’ll receive an email containing the Bank account details for transferring the course fees.

Step 4: After we receive the course fees, we’ll email you the instructions to download the course files to the email that you’ve mentioned in the Non-Disclosure Agreement Contract.

The whole process is smooth, and I’ll guide you at each step. If you’re stuck or need help at any stage, email me immediately at [email protected] – I’ll help you as soon as possible.

The RangeBound Trends – The Powerful and Time-tested Methods to Make Consistent Profits Using Sideways Trends

Special Price: 81,500 INR (The Course Booklet (A Protected Digital PDF) for Lifetime Access, with a One Year of Personal Support.

Here’s What You’ll learn within this Unique One-of-a-Kind course!

How to trade when the Price enters into the Rangebound trend (phase)?

How does it work in day trading (5-minute timeframe) and swing trading (Daily timeframe)?

How to use this system even if you don’t know about other Gann’s methods?

Over 40+ example charts to help you to understand the concept well.

Traders with small trading capital (around 1-2 Lakhs) can use this system.

Special Price: 81,500 INR (The Course Booklet (A Protected Digital PDF) for Lifetime Access, with a One Year of Personal Support.

Important Details

In case of any issues related to payment, feel free to send an email to [email protected] – I’ll help you out as soon as possible.

Once your payment is completed, you’ll receive an email about the steps involved in accessing the Protected Course Digital PDF file.