Last week first Bank Nifty triggered Buy above weekly Resistance, which ends up hitting stop loss.

Then sell trade gets activated below the weekly support level, and it did our second weekly target. The Bank Index ended the week with 259 points gain.

In the coming week, Bank Nifty is approaching the critical Fixed Time Cycle period. The volatility can be high with quick turn around’s.

The previous was a bit sluggish inaction due to the short trading week. But, following the lower time frames like an Hourly or 15 min chart can give us some better trade opportunities.

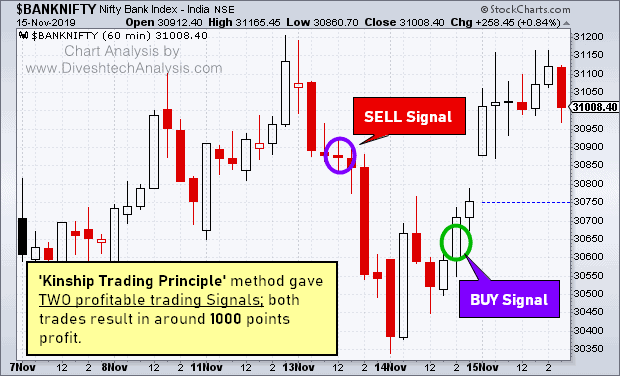

Like last week on an hourly chart 1st, we got the Sell-Signal on 13th Nov, which result in around 450 points profit.

Then, later on, 14th Nov, we got the Buy-Signal by using the same ‘Kinship Trading Principle’ method. The Buy-Signal result in around 500 points profit move.

The in-depth study of Progression and market structures always gave the safest and profitable trading opportunities. Like our ‘Kinship Trading Principle,’ which is based on the ‘Law of Progression’ of market structures.

Bank Nifty Weekly Forecast

After making the low near to one of the critical Gann angle support lines, Bank Nifty continued it’s upside journey.

In the next week, 31250 will act as the crucial hurdle of Bank Nifty bulls, above that we can rally of 250/600 points.

On the lower end, 30800 will be the Support to watch, below that we can see a dip towards 30600/30200 levels.

In the forthcoming week, 18th & 22nd Nov are the critical dates.

Bank Nifty Weekly Trading Levels

Next week 31100 will act as Resistance above which move towards 31250/31500/31900 can seen.

While Support is likely to come at, 30900 below that move towards 30750/30500/30100 can be seen.

Note: Above mention Price projection & other Information are for educational purpose only.