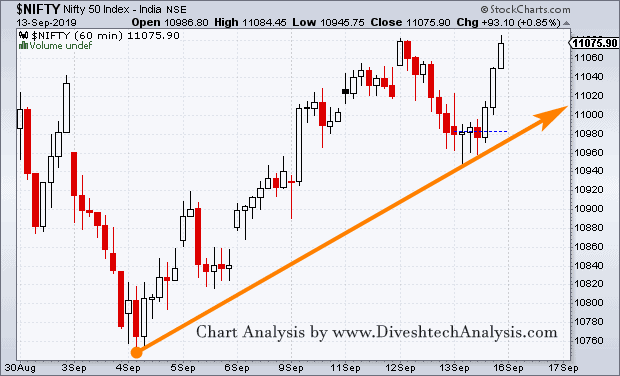

Last Week, above 10965, Nifty did our 1st target and missed the second target by 15 points.

The Index ended the week with a 129-point gain. The Nifty50 Index will approach the Critical Fixed-Time Cycle period in the Coming Week.

On the hourly chart, bulls need to trade above 11110 to move towards 11165/11240.

The bears, as per the hourly chart, will get the chance below 10940 to move towards 10875/10800 levels.

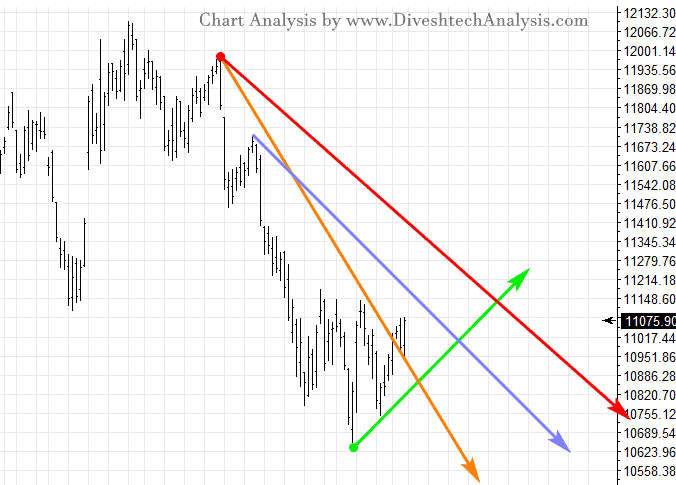

As per the Daily Chart, the Nifty Bulls broke the Gann angle line resistance (orange colour) last week and strengthened for the upside.

In the coming week, Bulls need to break & trade above 11090 to maintain the ongoing bullish tone.

On the lower side, critical support is at 10940. Below that, we can see the Index sliding towards 10800.

Nifty Weekly Forecast For the Week 16-20 Sep

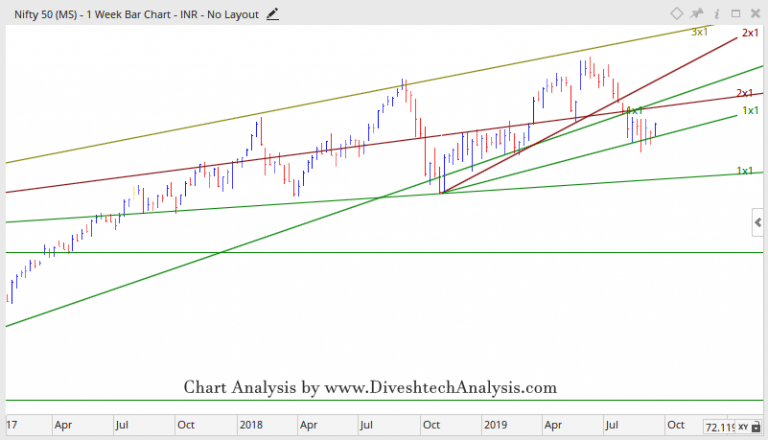

We discussed this section of the Nifty Weekly Forecast last week. For the coming week, we will also stick with our 10750 levels as Support. The Resistance on the upper side is located around 11250 levels.

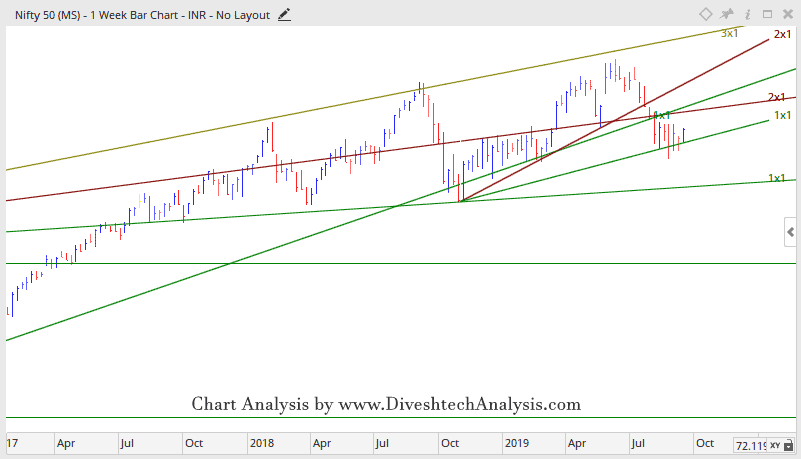

The market forces on the weekly charts are almost neutral at present. In the coming week, Nifty bulls need to break and close above 10185 to maintain the short—to medium-term upside.

In the forthcoming week, 17 & 20 September are the critical dates.

Nifty Weekly Trading Levels

Next week, 11090 will act as Resistance above, which moves towards 11150/11225/11350 can be seen.

While Support is likely to come at 10940, below that, a move towards 10880/10805/10680 can be seen.

Note: The above-mentioned price projection & other Information are for educational purposes only.