Trading is a serious profession.

It’s a profession where 95% of traders lose, and only 5% of the market players make money. And one of the primary reasons behind such a vast difference is of knowledge.

Most traders used conventional trading tools (knowledge) like indicators to trade. And that’s why most of them lose money in the trading.

So if indicators don’t deliver a reliable trading methodology, then what method should one use to trade?

The knowledge of TIME combined with PRICE is one of the lethal trading combinations that offer reliable trading results. And we used that a lot in our trading to catch the reversals in trend.

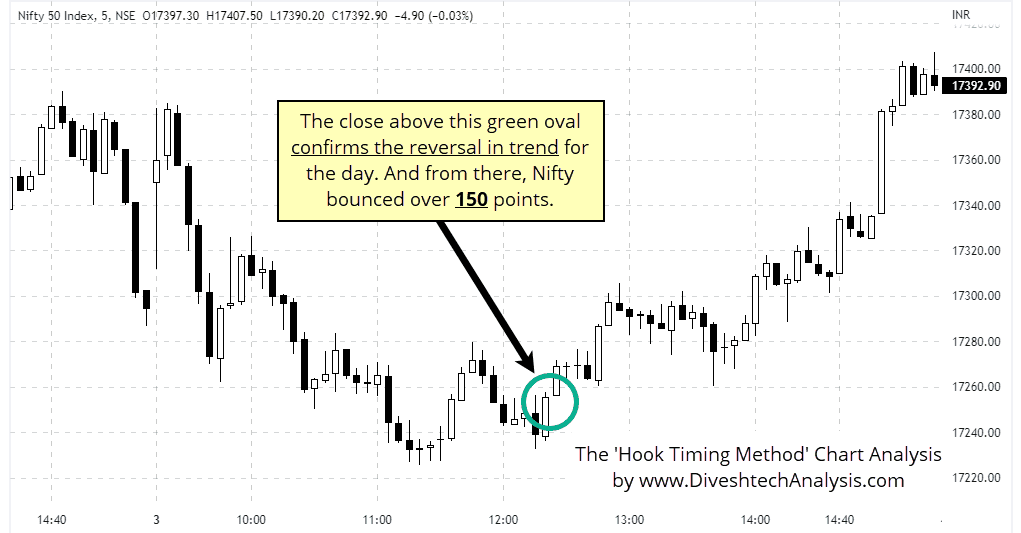

For example, if we see today, first Nifty went (traded) down, then it reversed upwards. That move from down to up offered a great trade. And below is the chart showing where exactly the trend reversal happened from down to upwards.

So, remember that indicators are not reliable trading tools. And they are not reliable because indicators are lagging in nature. So they often give false or late signals for reversal in trends.

And so, if you want to improve your trading results, look for the high probability trading tools like the one our students use to trade and catch the reversal in trends.

To catch today’s trend reversal, we used our Hook Timing Method. And if you want to know more about that trading method, then click here, or you can read the posts below to understand more about the Hook timing method.

How ‘TIME’ Played a Crucial Role in Today’s fall?

Hook Timing Method Gold Market Powerful Downside Turn

An Essential Trading Skill that Every trader Needs to Trade the Volatile Markets

Bank Nifty Volatile Dynamic Trading Market

Trading Nifty Downside Swing for 300 Points Profit

A Classic Example of How the Price & Time Structures Works in the Markets