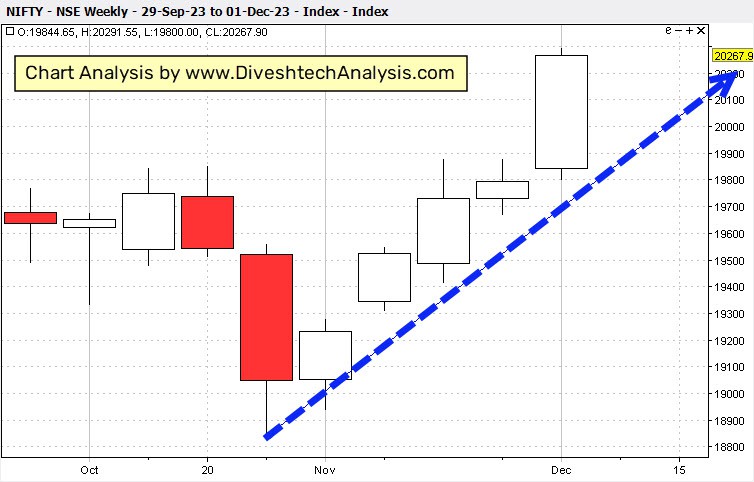

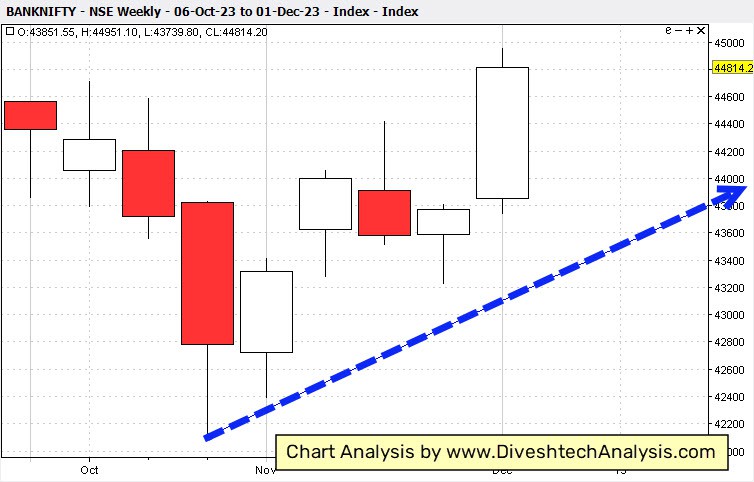

Last week, the Nifty gained 473 points, while Bank Nifty rose by 1045 points.

In the coming week, the trend of Nifty can be identified through a range of 20110-20090. If Nifty breaks and holds below 20090, the bears could become stronger. On the other hand, if the Nifty breaks and sustains above the crucial Gann price point of 20360, the bulls will gain an advantage.

If Bank Nifty breaks above the 45100 level and holds, then that will strengthen the Bulls more. On the downside, the 44400 point is a crucial support point.

Weekly Gann Levels for the Nifty

According to the Gann analysis, the 06th of December is a critical date for Nifty.

A break and hold above the 20360 Gann resistance level could take the Nifty 50 Index higher toward the 20420/20510/20700/20900 levels.

Based on the Gann Analysis, the lower support is at 20090. If the Nifty breaks and remains below that level, it could decline towards the 20030/19940/19800/19600 levels.

Members-Only Reports

A Weekly & Special Private Report that provides you with detailed Time-Specific Turning Points for Nifty, Bank Nifty, Crude Oil (MCX), Gold (MCX), USDINR, and volatile stocks like Reliance.

Yes, I Want More Information

Weekly Gann Levels for Bank Nifty

The 06th of December is critical for the Bank Nifty Index as per the Gann analysis.

A break and hold above the 45100 resistance level could lift the Bank Nifty Index towards the 45300/45600/46000/46500 levels.

The Gann support level for Bank Nifty is at 44400. If the Bank Index breaks and remains below that level, it could decline towards 44200/43900/43500/43000.

Note: The above levels are for educational purposes. Not Buy/Sell advice.