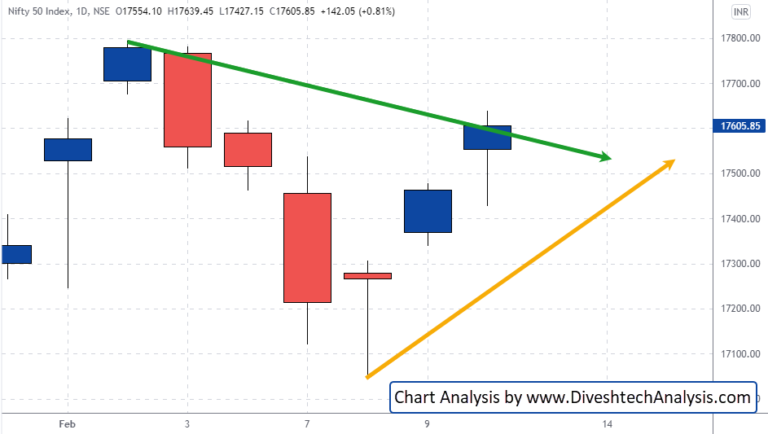

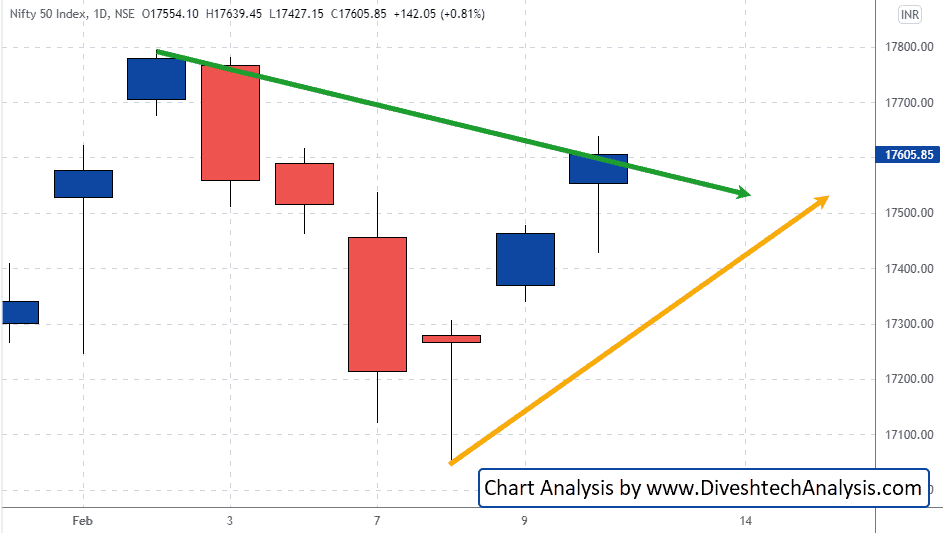

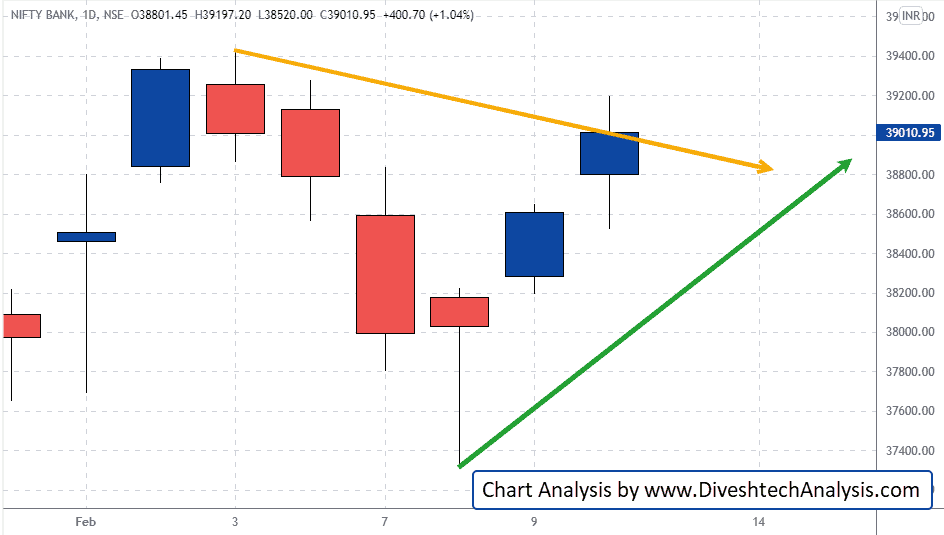

Today Nifty & Bank Nifty both opened gap up. Then both the indices moved a bit down and failed to break the support levels (17410/38450) discussed yesterday. And then finally both heads higher and ended the session with nearly 1% gains.

Now the support levels for both indices have shifted higher.

Until Nifty is holding 17490-450 zone, bulls are strong & they can take Nifty towards 17800/17900 levels. On the upside, the 17650-665 zone is the resistance.

Bank Nifty needs to hold the 38800-700 zone for further upside. And on the upside, the 39200-300 zone is the resistance.

Subscribe & Get YOUR FREE COPY of the Nifty Cycle Dates Report!!

In ten minutes (or less), discover the important weeks & months for the entire year 2022, where markets can make a swing (high or low). Click here to subscribe and get it right away.

Nifty Intraday Gann Levels

Nifty bulls need to break & sustain above 17665 to move towards 17700/17750/17810/17880.

On the lower side, the Gann support level is 17580; below that Index can move towards 17540/17490/17430/17360.

Bank Nifty Intraday Gann Levels

Bank Nifty bulls need to break & sustain above 39150 to move towards 39300/39500/39750.

On the lower side, the Gann support level is 38800; below that Bank Nifty Index can move towards 38650/38450/38200.

Note: The above levels are for educational purposes only, not Buy/Sell advice.