Successful trading is about the process you follow in your trading.

A successful person is one whose vision, purpose, & the game plan is clear.

The same process connects to trading. Your vision, purpose, and game plan should be clear before you start your trading journey.

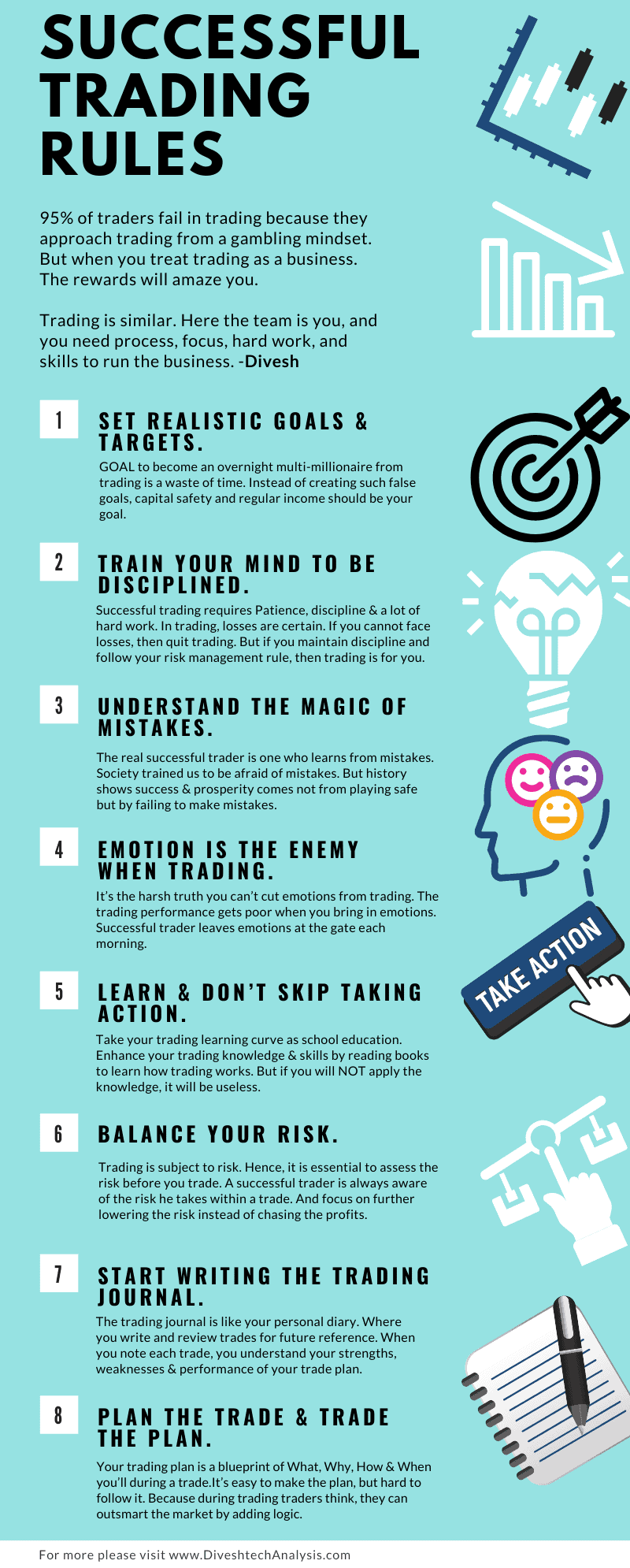

95% of traders fail in trading because they approach trading from a gambling mindset.

If you will treat trading as a business the rewards will stun you. Any business gains success because of its process, hard work, & skills of its team members.

Trading is similar. You need process, focus, hard work, & skills to run your trading business.

Today’s post is about such a process only. That one needs to follow to make the trading business worthwhile.

Successful Trading Demands Realistic Goals & Targets

GOAL to become an overnight multi-millionaire from trading is a waste of time.

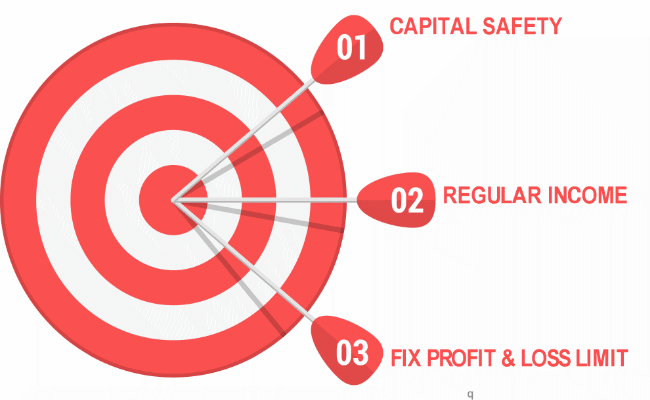

Instead of creating such false goals, capital safety and regular income should be your goal.

Also, keep your targets realistic.

The target to earn 25000 INR daily from 75000 INR capital is unreal. To make 25,000 INR through 75,000 INR capital, you will take more risk & leverage.

Instead of creating such an unreal target, Fix your Profit and loss limit for every week.

Set a suitable amount you can afford to lose in a single week.

Then, divide the amount into five (the number of trading days in a week) for the daily loss limit.

Assume your weekly loss limit is 10,000 INR. So, 10,000/5 trading days = 2000 Rs is your daily loss limit.

Suppose your trades result in a 10,000 INR loss from Monday to Wednesday. Then, you will avoid trading for the rest of the week.

Also, set the weekly profit limit. As you earn, such amounts avoid trading for the rest of the week.

Train Your Mind to be Disciplined

Successful trading requires Patience, discipline & a lot of hard work. Next, you need tactics to reduce the risk & trading with a plan.

Once you make the plan, follow it with discipline.

Your trading plan may not always perform, but it can reduce risks. When you experience a loss, accept it as part of the business.

Suppose you follow your trading plan with discipline. And then also you experience the loss.

In that case, you also have to follow your trade plan with full discipline. Remember, later, you can improve your trading plan. And make it fit every trade you do.

In trading, losses are certain. If you cannot face losses, then quit trading.

But if you maintain discipline and follow your risk management rule, then trading is for you.

Treat Mistakes as an Opportunity to Learn

The successful trader learns from mistakes.

Society trained us to be afraid of mistakes. One learns to react to mistakes with anger, insult, and fear.

History shows success & prosperity come not from playing safe but from failing to make mistakes.

Mistakes will happen, your trade plan can go wrong, and you may lose cash.

But let your losses become your strength. Examine why you lose. Then, use past mistakes for a better tomorrow.

Such a mindset will help you understand different trading states. And you will learn how to handle them next time.

Mistakes are not blockades. They are the future’s guidelines and use mistakes as tool for successful trading.

Emotions Are The Enemy

It’s the harsh truth: you can’t cut emotions from trading. The trading performance gets poor when you bring in emotions.

Successful traders leave emotions at the gate each morning.

Boston University conducted research to study how stress and emotions affect trading. They spot vital clues like heart count, body temperature, and respiration as traders’ thoughts shoot in and out of trade.

The results suggest that traders who let their emotions get their best lead to fare poorly. But traders who weigh on logic alone don’t do well either.

The most successful traders use their emotions to their favour without letting their feelings crush them. The best traders are the ones who control emotional responses.

Professional players also react with the same. They never let emotions win over them. They use emotion to drive them up.

Suppose you’ve made a loss. Taking a loss isn’t a big deal if you understand how to move out without letting it affect your future trades.

But you get angry. You were sure trade was moving in loss, and now you’ve wiped out three months of profits on a single trade.

This kind of anger emotion as usual. But if you carry it in your next trade, you will put your entire portfolio at risk.

When you trade with anger emotions, you do all you can for a profit. That means forcing trades, holding too long, and taking negative actions that set your trades at risk.

Anger emotions after a trading loss are common. But taking that into your later trades destroys your skill to trade well. And the strength of successful trading.

‘Learning’ and ‘Action’ Lead to Successful Trading.

When one hears the word learning, think of school, where one met love (and rejection), & where one experienced crushing boredom.

Those who struggle in school view learning as a task. But the effort pays dividends.

Likewise, take your trading learning curve as a school education.

Enhance your trading knowledge & skills by reading books to learn how trading works. The study will take time & devotion. But the effort pays dividends.

After learning, don’t skip taking ‘ACTION.’ Knowledge is power. But when you take ACTION.

I’ve seen many traders who study hard, but they don’t use knowledge in action after learning.

Knowledge is essential. Without knowledge, you can’t trade. But putting knowledge into action is vital.

You can read books & learn everything inside it. But if you do NOT apply the knowledge, it will be useless.

Books, seminars, and online programs won’t work until you execute your knowledge.

Learn to Balance Your Risk for Successful Trading

Trading is subject to risk. Hence, it is essential to assess the risk before you trade.

A successful trader is always aware of the risk he takes within a trade. And focus on further lowering the risk instead of chasing the profits.

A successful trader is always aware of the risk he takes within a trade. And focus on further lowering the risk instead of chasing the profits.

They know the market can become volatile. Therefore, they trade with stops to save their capital.

Chasing big numbers always seems exciting. But it’s best not to risk total capital on a single trade.

For success in trading, the skill to protect capital is needed.

To achieve this, set the amount in the percentage you can afford to lose per trade. Most traders set limits ranging from 1% to 3%.

After setting the amount, trade the quantity that matches your risk limit.

Start Writing The Trading Journal

The trading journal is like your personal diary. Where you write and review trades for future reference.

A trading journal is an excellent way to track & study progress. When you note each trade, you understand your strengths, weaknesses & performance of your trade plan.

You will list the below entries in your trading journal.

The entry & exit date. Length & Result of the trade. Your Profits or loss from the trade, Market conditions on the day of trade, Logic for Entry & exit trade with risks.

Your trading journal can become your best coach when seen in hindsight.

You Must Plan The Trade & Trade The Plan

Your trading plan is a blueprint of What, Why, How & When you’ll during a trade.

The trade plan covers your Entry, Exit, and Stop loss rules. It’s easy to make the plan but hard to follow it.

The fact is traders create a plan, but they never follow it. Because during trading, traders think they can outsmart the market by adding logic.

Like “Market is moving higher, but my stock is not, I better get out.” or “The Stock has moved a lot on the upside; I don’t think it will go more.” Or “My stop loss has hit, but the stock is in the oversold range; I will wait to see if it will bounce back.”

Such ideas will pull you down. It’s better to focus on the process and ensure you have followed your trade plan.

The Bottom Line

Make sure you follow simple trading concepts. The desire for holy grail methods & rules is a waste of time.

To succeed in the trading business, you need to take advantage of your emotions, knowing that you will often be wrong.

Be patient in waiting for setups & for the market to move once you get into a trade. You won’t be right every time, but you’ll be right.

May the trend be with you! – Divesh