Most traders consider the Rangebound price areas worthless. And they think they will take the trade when the trending move starts in the market.

But avoiding the Rangebound price areas is a big mistake because the Rangebound price areas offer significant clues about the upcoming trending move.

And here’s a classic example of that mistake that most traders make.

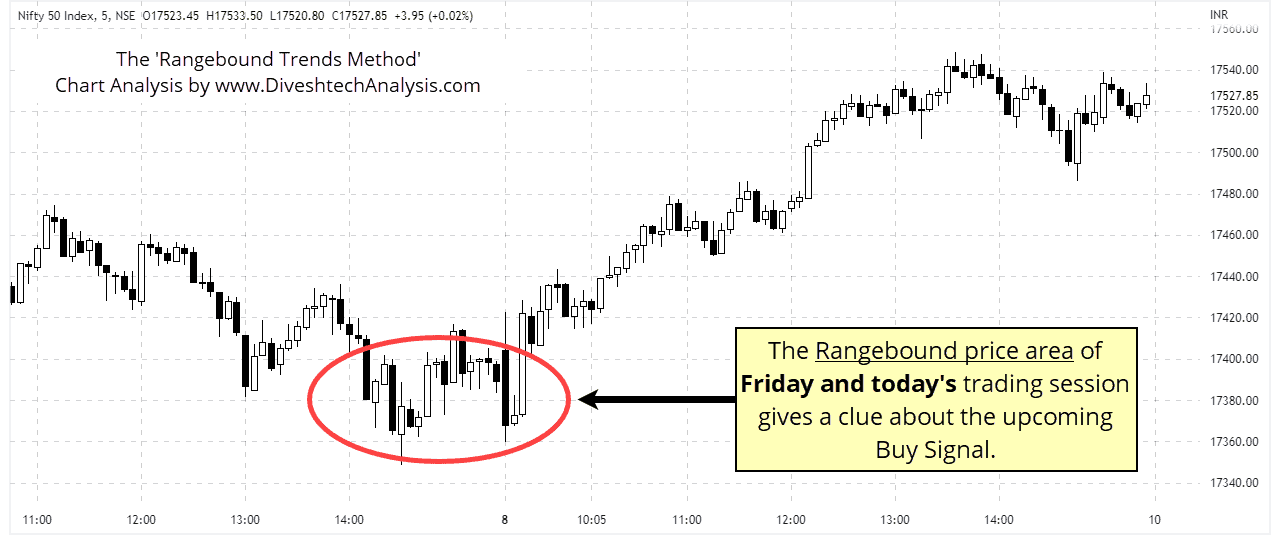

Above is a Nifty 05-minute chart of Friday and today’s trading session. In that chart, the RED oval circle is the Rangebound price area, which gives the critical Buy signal for today’s trading session.

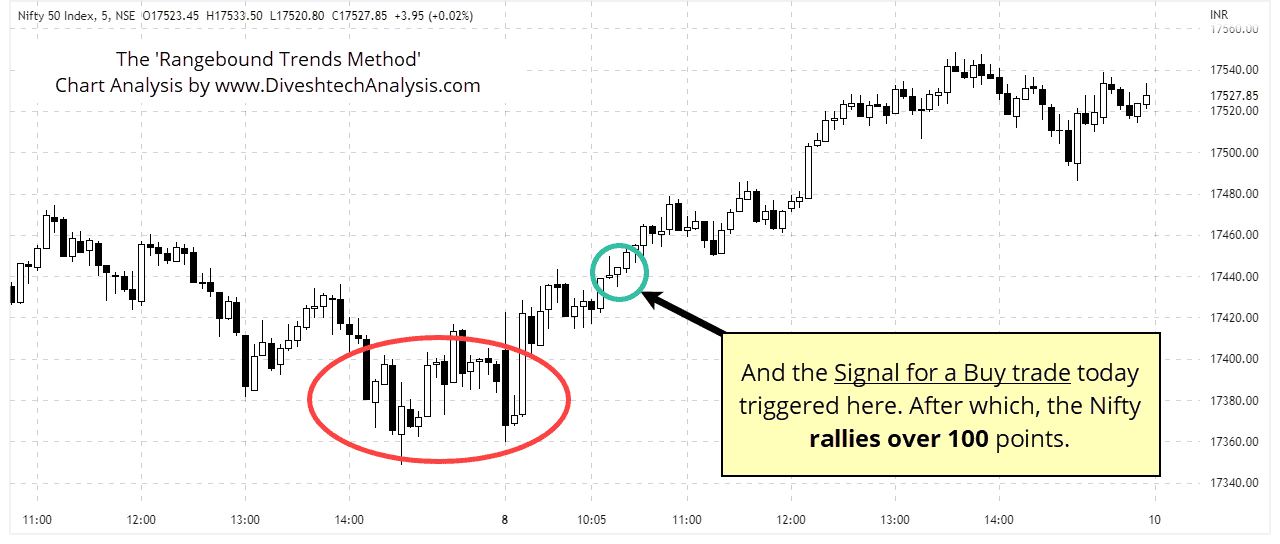

See the chart below for a clear view of the Buy signal. And after the Buy signal gets triggered, the Nifty rallied 110 points from there.

So, that’s the power of the Rangebound price areas; they offer hints about the upcoming trending moves.

But sadly, most traders avoid studying the Rangebound areas, so they miss the highly profitable trading opportunities.

But if you as a trader don’t want to avoid the Rangebound price areas, then look at our unique Rangebound Trends Course. It’s a one-of-a-kind course where you’ll learn to trade the Rangebound areas like a pro.

If you want to know more about the Rangebound trends method, then click here or read the posts below to understand more about the method.