Last week, the Nifty opened a gap down and met all three weekly targets. The Index ended the week with a gain of 112.30 points.

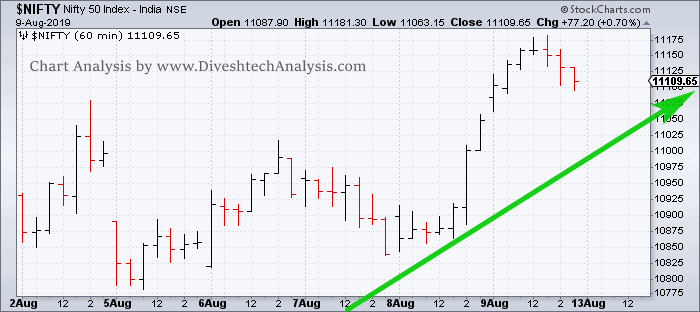

We also discussed the Nifty approaching a critical fixed-time cycle period. That time cycle shows its effect quite well, and from Monday’s lows, the Index rallied nearly 400 points.

On the hourly chart, Nifty bulls need to trade above 11155 to rise towards 11200/11260.

Nifty Bears will get the chance only below 11000 for the move towards 10950/10880.

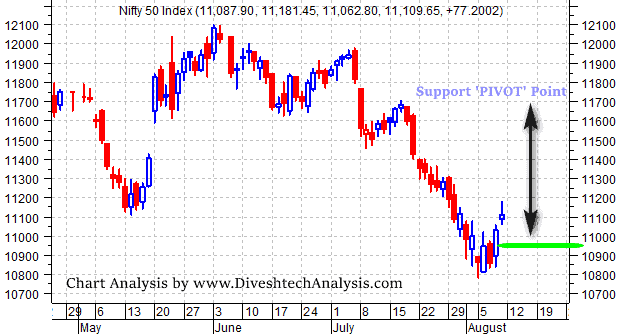

The Bulls have gained some strength and energy on the daily chart after breaking last week’s angle line.

To maintain momentum, bulls need to close at 11150, and on the lower end, 10940 will act as a support Pivot.

Nifty Weekly Analysis For Week 13-16 Aug

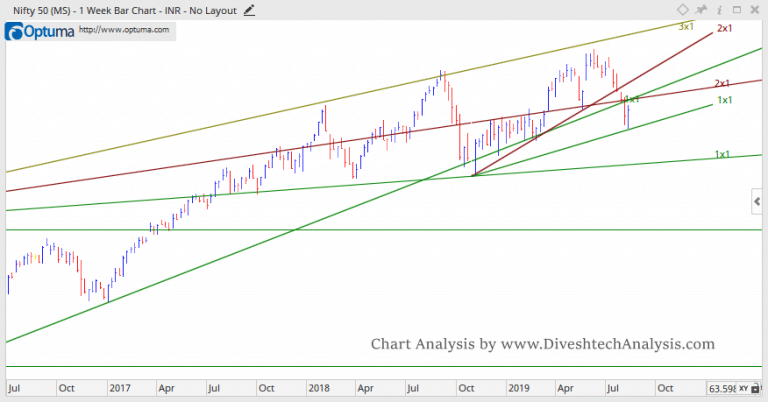

We discussed this section of Nifty Analysis last week. Below 11200, the Nifty bears fell 350 points. Now, 10800 is the Critical level for bulls to hold for a bounce-back in August.

In the previous week, Nifty made a low of 10782 and failed to sustain below 10800 levels. From that point of Support till now, the Index has bounced 400 odds points.

We can see more upside in the coming days. On the weekly charts, forces are a bit in favor of bulls now, but we need to look for more confirmations.

In the forthcoming week, 13th August is the critical date.

Nifty Weekly Trading Levels

Next week, 11190 will act as Resistance above, indicating a move towards 11245/11310/11400.

While Support is likely to come at 11030, below that, a move towards 10975/10910/10820 can be seen.

Note: The above-mentioned price projection & other Information are for educational purposes only.