Last week Nifty above 11600 almost reached our 2nd weekly target. The Index ended the week with 133 points loss.

Friday’s fall in the Index is an indication of more weakness in the markets.

On the hourly chart, the Bulls need to trade above 11500 to move towards 11555/11625 levels.

Nifty Bears will get the chance only below 11350 for the move towards 11295/11220.

On the Daily chart, last week’s Index broke crucial short-term Support, which indicates the probability of a further drop.

We can use Daily chart level 11340 as a pointer. On trading or closing below 11340 will add more bearishness to the Index.

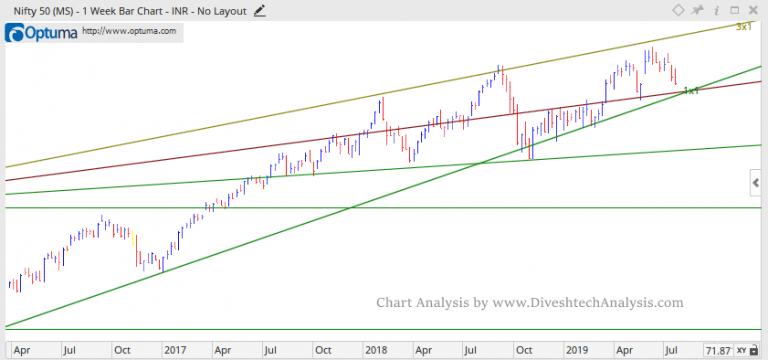

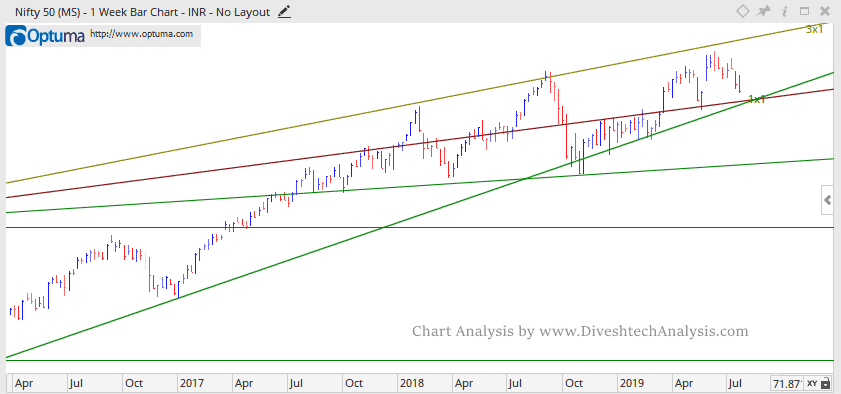

Nifty Technical Outlook for the Week 22-26 July

Last week, in this section of Nifty Technical Outlook for week analysis, we discussed the following: For reversal, the Index needs to hold 11450 on a weekly basis. Multiple confirmations suggest we may see the Pivot (Support) around 11450.

We saw the rise, but the Nifty bulls failed to continue the momentum. Now, the Nifty has closed the week below 11450 levels, which indicates more pain for the bulls.

In the forthcoming week, 23 & 25 July are the critical dates.

Nifty Weekly Trading Levels

Next week, 11515 will act as Resistance above, which moves towards 11570/11635/11755 can be seen.

While Support is likely to come at 11340, below that, a move towards 11285/11220/11100 can be seen.

Note: The above-mentioned price projection & other Information are for educational purposes only.