Today we will examine whether the markets (Nifty 50 Index) can make a bottom in December.

Let’s be clear, friends.

It is NOT a forecast you see on social media or YouTube, where people talk without facts and figures.

Instead, we will discuss the possibilities that may or may not happen. Trading is a probability game. So this analysis (view) may go wrong as well.

We will examine the things based on the tools and cycles I’ve been using for decades for my trading. So let’s start.

First, let’s review what the Price is telling us.

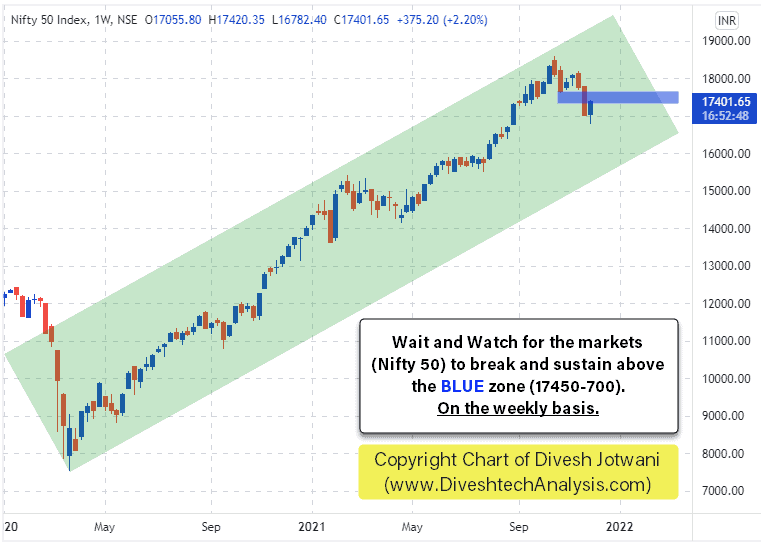

Below is the Nifty Weekly chart I shared with our blog-free email subscribers on Friday before opening the market. In which we discussed that the 17450-700 zone is critical for the bulls.

In Friday’s session. Nifty reverses from the 17450-700 zone, which shows weakness in the markets. The 17450-700 zone is crucial for this downtrend, and bulls have to give lots of effort to move & sustain above it. See the below chart after the Friday trading session.

Bears are in a strong position until the Nifty is not making a weekly close above the 17450-700 zone. And they can drag the Nifty towards lower levels.

On the downside, the 16500-250 zone is the strong support zone as per the Gann rules. So, if the Nifty breaks the November month low (16782), it can reach the 16500-16250 zone.

We will now analyze what TIME is saying.

Nifty made the high top in October. That was the crucial month for Nifty. And the chances for the top or trend change were higher in October.

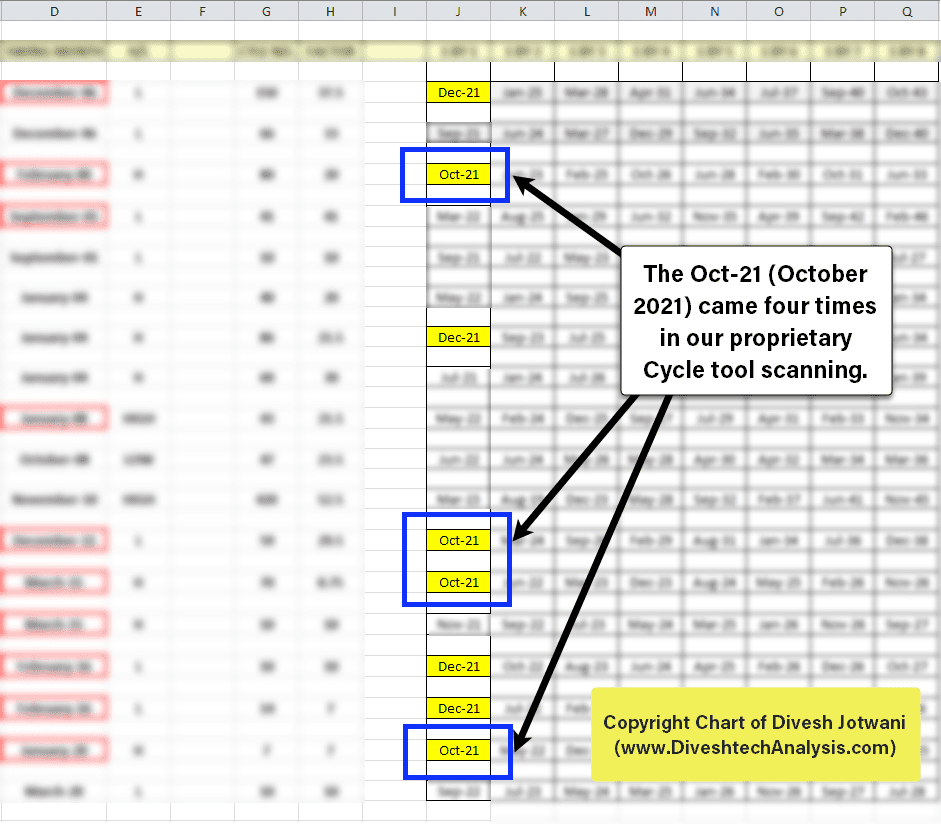

How? See the Excel sheet below. The proprietary Cycle tool we use to calculate the future turning months.

The sheet shows that Oct-21 (October 2021) was coming four times. Check BLUE square boxes. And Nifty exactly made the high in October month.

In the same way, our proprietary Cycle tool now shows that December is a crucial month for Nifty. See the 4 (RED) square boxes. That means Nifty can make a turn in December. And the turn should be on the upside from the December month low.

Why, on the upside?

Nifty was in an uptrend before October, so it topped and moved downwards. And now, in December, the Nifty is in the downtrend, so the turn should happen on the upside from December.

In simple words, Nifty can make a bottom in December, and it may start moving higher.

What’s the one thing you can do today with this analysis?

If you are long in the markets, you should decide the stop-loss points if markets fall more from here.

Or if you are sitting in cash. Then wait for December to get over. And after December, re-analyze the charts, and see the Price action to check whether buying is coming back to the markets or not. – Divesh.