Last week, Reliance Industries (RIL) was the star of the week.

The over 12% rally in RIL supported the Nifty Index, and bulls bounced back towards 11500 by Friday.

But the talk of the town during the weekend was SEBI’s New Rule on Multicap Funds Asset Allocation.

Because of that, traders are expecting weakness in Large-cap stocks and bullishness in Mid and small-cap stocks.

So, now It will be interesting to see how the market will react to this new change.

As a trader, you should stick with your trading levels. The rest is NOISE.

In the coming week, No major cycle is there.

But significant monthly cycles can show their impact; you can learn more details about ‘Monthly’ cycles, and their influence on markets in the two posts.

- Let’s take history as a guide for SEP month.

- The Cycle of Lows in Nifty 50 Index.

Nifty Weekly Analysis

In the coming week, 15 & 18th Sep are the Important Gann dates.

Nifty Weekly Trading Levels

Next week 11500 will act as Resistance; above that, 11550/11620/11770 levels can come.

The 11320 will act as Support; below that, 11270/11200/11050 levels can be seen.

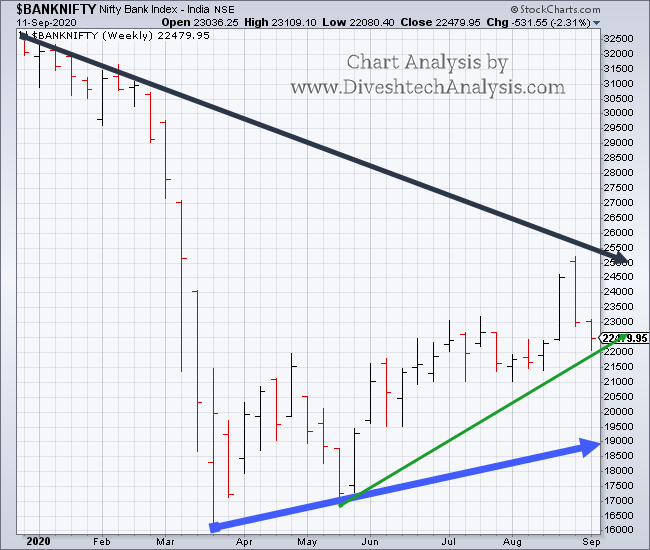

Bank Nifty Weekly Analysis

The interest waiver and moratorium extension case in the supreme court gets postponed for two more weeks.

But that didn’t support much to the Bank Nifty Index. And Index ended the week with a 530 points loss.

In Bank Nifty Index Rise Ahead? Post, you will find Index analysis from a broader perspective.

That will help you better understand the present state of the Bank Index on the technical front.

In the coming week, 15 & 18th Sep are the Important Gann dates.

Bank Nifty Weekly Trading Levels

Next week 22600 will act as Resistance; above that, 22720/22880/23280 levels can come.

The 22180 will act as Support; below that, 22060/21900/21500 levels can be seen.

Note: Above mention Price projection & other Information is for educational purpose only.