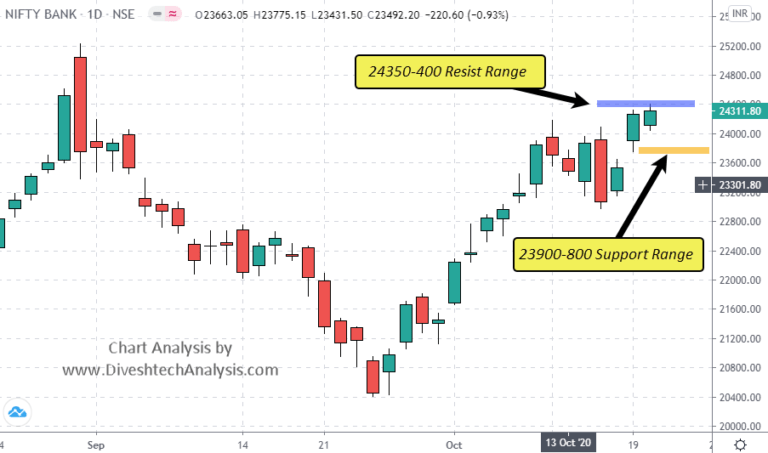

In the last Nifty Bank analysis, the first bears did a low of around 23950. And after that, the bulls are doing well above the 23900-24100 range.

The Nifty Bank bulls are doing well above the crucial market structure.

So, the chances are high that Bank Nifty can show a 700-1200 points upside move in the next few trading sessions.

But it’s always better to trade level to level rather than make assumptions.

From the Gann analysis perspective, Nifty Bank bulls should continue to hold the 23800-900 range. And for the further hefty rise, it would be great if this week’s close should be above it.

Any dip near the 23800-900 level can be a buying opportunity with limited stop-loss.

But from the present price 23800-900 is still quite far.

So, in such cases, one can look for buying opportunities if Prices sustain and hold above the 24350-400 range.

The potential target on the upside will be around 24700/24950/25300 levels.

I hope it will help. I’ve done the groundwork. Now you have to see how you can take advantage.-Divesh

Note: The above-mentioned Price projection & other Information is for educational purpose only.