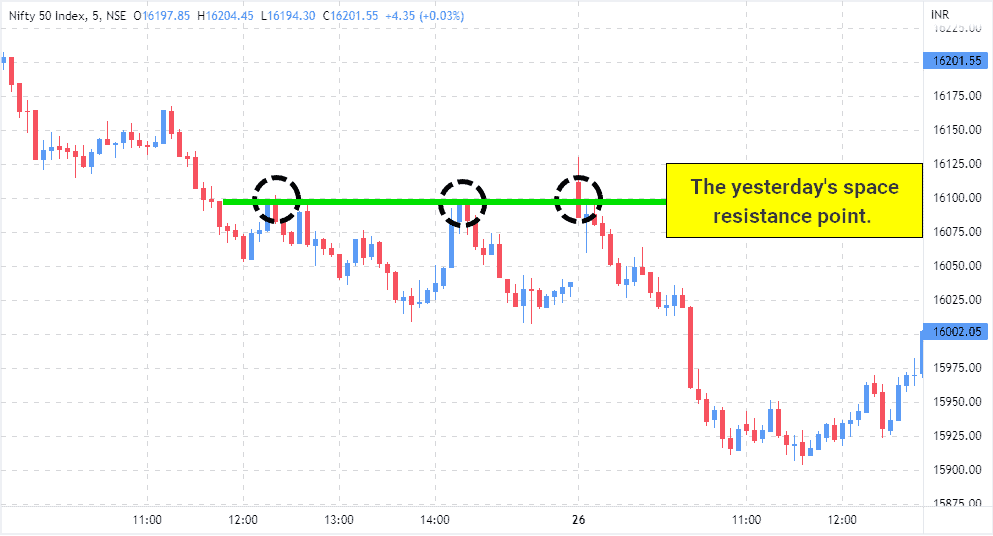

The market actions are the greatest teacher they have their special way to express and hint about future actions. And to understand one of that lessons we’ll continue with our yesterday’s Gann’s SPACE point. So, if you have not read that post, then first please read that post before reading below.

Nifty today opened with a gap-up and moved a few points above our yesterday’s space resistance point.

And that was a fake price action to trap the buyers.

Because most of the time. When the next day market (price) opens and starts trading above or below the breakout level with the very first bar, it marks the reversal most of the time (at least temporary).

So, in that case, it’s always safe to wait and take action on the breakout when the price gets closed above that breakout bar high (which means the first bar high). And, if prices close below the first breakout bar low within the next few bars, then most of the time that acts as the reversal.

And the same happened today.

So, first, nifty opened with a gap above our space resistance point, and soon, it got closed below the first bar low (which opened and traded above the resistance point). And that was a clear hint for a forthcoming down move, and that happened. So, that’s our first crucial lesson.

Now let’s move ahead to understand why it’s so…so important to go with the flow without a second thought.

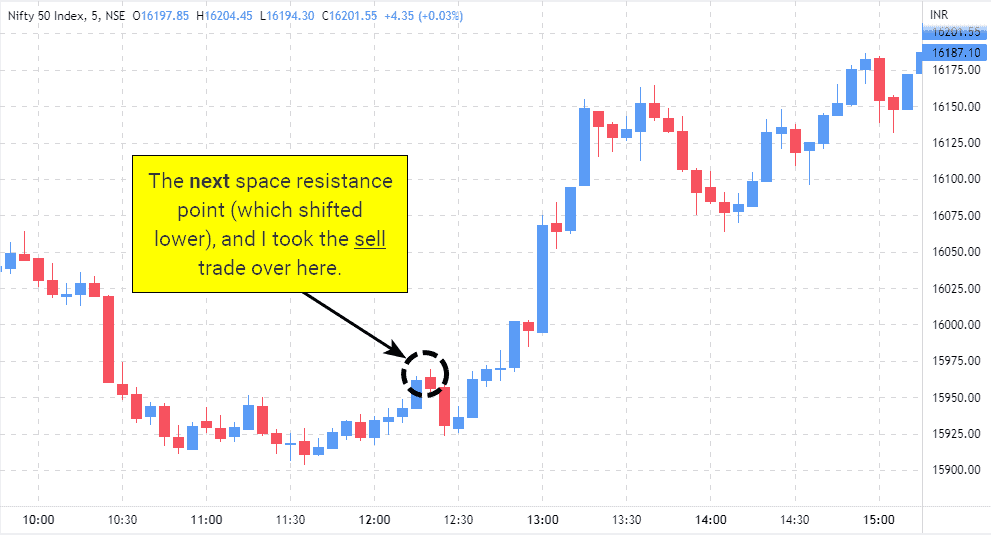

I didn’t trade the down move that happened just after opening because today I reached the office late.

When I started the day (for trading), I found the Nifty was trading near the next space resistance point (which shifted lower). So, I took the sell trade, and soon my sl got hit.

As you know, I prefer to go with the flow. So, soon, I reversed my position to buy (as the price closed above the space resistance point), and that trade rewarded me well, as, from that breakout point, the Nifty jumped 250 points.

So, again, I would repeat that go with the flow without a second thought.

To control second thoughts, you have to spend a good amount of time with the tools (techniques) you use to trade. There is no alternative, so start today.

If you want to learn the ‘Kinship trading principle ‘technique that I have used on the above trades, then mail me here for more details.