The volatility will remain high because of the next week’s US Presidential Election.

Last week, both the Indices moved lower, but the Bank Index is still trading in the buyers’ safe zone.

But the game can change. That’s why it’s better to make Plan B also in case the market didn’t move as per expectations.

The week ahead is also crucial because many time cycles will reach their endpoint. Again, the best time for intraday traders ahead.

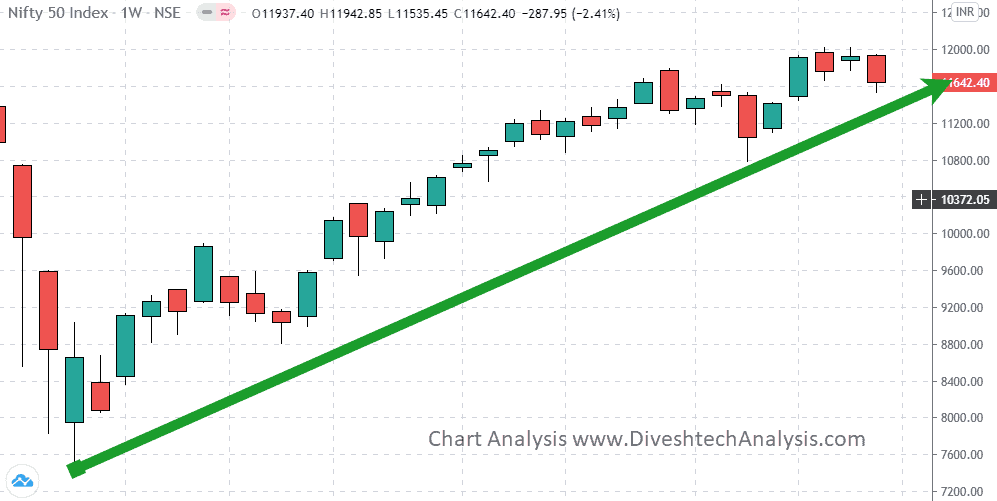

Nifty Weekly Analysis

In the coming week, 04& 05 November are the critical Gann dates.

Next week 11600 will act as Resistant. Above such, the Gann level Nifty Index can move towards 11550/11480/11350 levels.

The 11710 will act as support. And below such Gann level, Nifty can move towards 11760/11830/11960 levels.

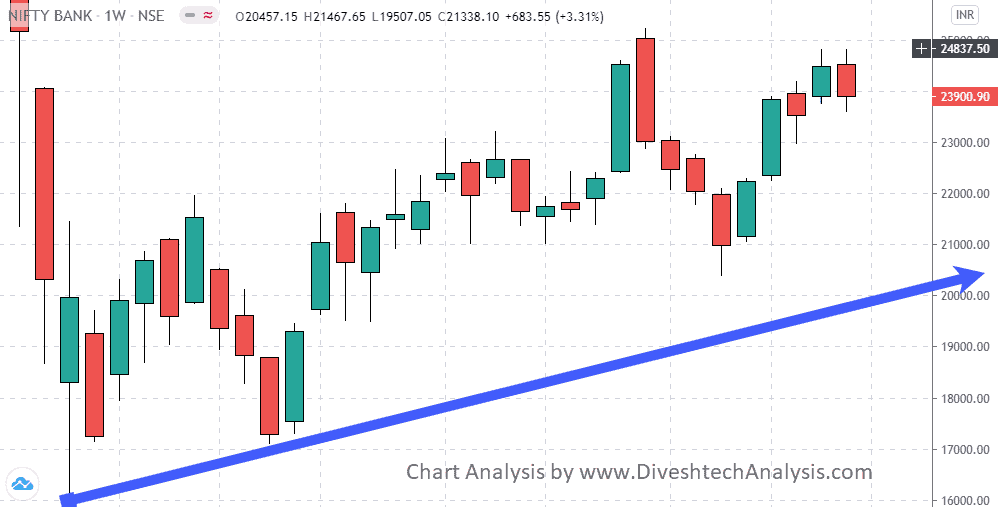

Nifty Bank Weekly Analysis

In the coming week, 03 & 05 November are the critical Gann dates.

Next week 24000 will act as Resistant. Above such the Gann level Nifty Bank Index can move towards 24150/25400/24850 levels.

The 23500 will act as support. And below such Gann level Nifty Bank can move towards 23350/23100/22650 levels.

Note: The above levels are only for study. Not a Buy/Sell advice.