Do you close your 4% profitable trade at 1% profit?

Do you hold losers’ stock too long and sell winner stocks too soon?

Do you sell your winner because of fear and doubt?

95% of traders lose money because of the trading strategy, limiting belief, fear and greed in trading.

5% of Skilled traders don’t face such problems. They use stops, control their emotions, and earn money.

Limiting Belief

The voice in your head judges you, doubts you, lowers you, and tells you you are not good enough.

Limiting beliefs stop you when you’re doing something that you do every day.

You often hold yourself from trading after the great study because your inner voice turns your mind that trade will not go in your favor.

You see a later stock move as per your research. It happens; the reason is your limiting belief.

FEAR in Trading

Fear is like a fight-or-flight response. You fear when you sense the threat.

You met a fatal situation; you sensed fear, and the fight-or-flight response hit your mind. Fear is a prison that holds you back from your potential.

Fear often stops you from entering a trade while trading.

Even if you enter the trade, fear drives your mind to set the tight stop loss or exit the trade before a big trending move starts.

Fear makes you nervous when your trade moves against your thought. You sensed a threat to your capital, and fear attacks your mind.

Suppose you purchased Axis Bank stock at the price of 500.

The stock declines. In a few days, it reaches 425 levels.

You become worried, and fear hovers in your mind. You close the trade because of fear at 425 levels, and the trade ends in 75 points loss.

Fear comes when you don’t understand something.

When you hear an odd sound at midnight, the natural response is a little frightening.

Then, you discover it’s just the cat roaming around; you understand what’s happening, and the fear goes away.

Typical traders don’t understand what they have to do under specific times, like the Axis bank example.

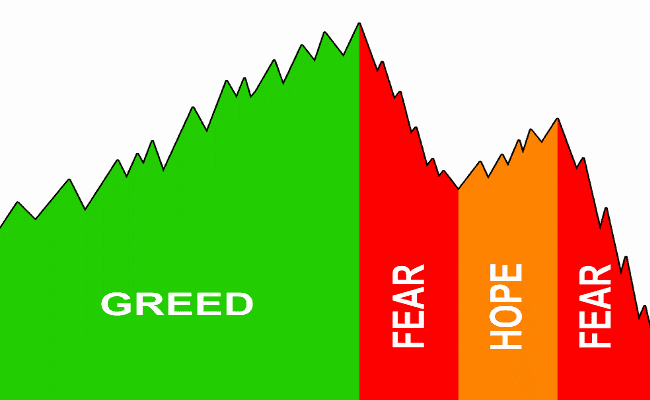

What is GREED in Trading?

Greed is a strong desire to win or get something. A quick buck or a thrill of the chase means greed.

Greed drives you to value instant benefits to the extent that you ignore future losses.

Greed is fueled by dopamine, an active hormone.

The joy of a reward fires off dopamine that makes you feel good. It makes you feel so good that often if you win the award, you feel down.

Greed on any level is bad. It is like a SIN that results in trading losses. Greed in trading also hits your winning trades from negative aspects.

Let’s say you bought Axis Bank stock at the price of 500.

This time, the stock moves up and reaches the 525, 540, and 560 levels.

But you didn’t book the profit because of greed.

And after a few days, stock move below 560, 550, 530, 520, and you close the trade at 520 levels – in 20 points profit only. Well, that’s how greed works in trading.

Most traders encounter such problems. The reason is simple fear and greed.

Now, the question is How to control fear and greed in trading to bypass such errors.

Through the right approach, every trader can reach such a stage. There is always a method behind what looks like magic.

So you can follow the below steps to solve the problem of fear and greed in trading.

Develop Positive Emotions to Control Fear and Greed in Trading.

The negative emotions drive us in a narrow range of thinking of what we are capable of doing.

If you let negative emotions control yourself. Then you will always work in survival mode. And limit the range of opportunities.

While Positive emotions increase the sight of opportunities, open your mind. And build new skills and resources to provide value to your life.

Negative emotions kick in mind when one uses words like “I don’t trade well” or ‘I’m angry” or doubts our study.

To build positive emotions, you should use words.

“I’ll follow my trading plan, “I’ll believe in my set-up,” I want to be a successful trader.”

Always Trade as Per Your Trading Plan.

Your trading plan is a blueprint of what, why, how, and when you’ll do.

The trading plan consists of your Entry, Exit, and Stop loss in trading rules. But there is more which you need to learn and practice.

First, Don’t jump into the trade without proper confirmation. The mistake most traders make.

Assumptions or guess-work never helps. So watch Price action or wait for breakouts to time your entries.

Second, Fix your winning and losing limit.

We all want to earn more and more money. But you should know where to stop. So you don’t become the victim of over-trading.

Fix how much you can afford to lose in a single week. And then divide the amount by 5 (no. trading days in a week) to know your per day loss limit.

Let’s say your per week loss limit is 10,000 INR. So, 10,000/5 Trading days = 2000 Rs is your per day loss limit.

Now in the week, on any day, as your per week loss limit gets over, you will stop trading. The same rule applies to the per day limit.

In the same way, you have to decide the profit limit per week & day. And as you earn such a profit, you will stop trading for the rest of the day or week.

Last, Fix Your Position-Sizing.

Most traders treat their accounts like loading trucks.

Stop this now. If you want to become a profitable trader. Don’t put the burden on your mind and account.

Use fix percentage-based stop loss method to manage your position size. It’s the best technique.

Make a habit of Writing the Trading Journal.

The trading journal is like a personal diary.

Where you list and review trades for better output and future reference.

The journal is the best method for tracking and studying the progress. When you document each trade, you understand your strengths and weaknesses.

Your trading journal helps you as an advisor. When next time you face the similar situation.

In your trading journal, you will list the following entries.

The entry and exit date. Length of the trades, Results of the trade. Your Profits or loss from the trade, Market conditions on the day of trade, Logic for Entry, or exit trade with risks.

You will soon feel a difference in your decision-making skills by creating the habit of writing a journal.

Conclusion

Now you’ve learned how to win over your limiting beliefs, fear and greed in trading.

You can start to bring your positive mindset to turn on your journey to become a profitable trader.

Don’t forget. There is always a method behind what looks like magic.

So now it’s your turn to show the magic. And push your trading to new heights.

If you liked this post, then why not share it?