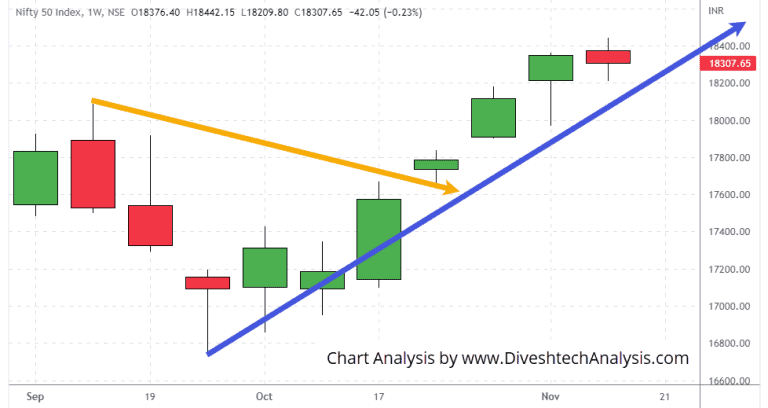

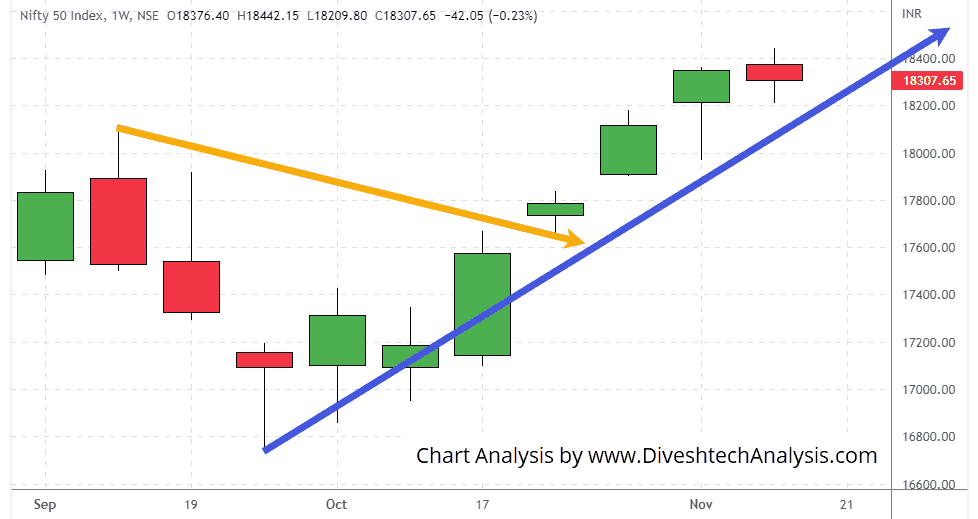

Both indices ended last week nearly flat. Nifty ended 42 points lower, while Bank Nifty closed 300 points higher on a close-to-close basis. So, it was almost a consolidation week for both indices.

Next, the 18100 will play a vital role in deciding the weekly trend of the Nifty. On the upside, a sustained move above the 18470-500 zone will strengthen the bulls.

For Bank Nifty, the 42600 range is critical. A sustainable move above that zone can push the Bank Index higher. And 41950 will act as support on the lower side.

Nifty Weekly Gann levels

Next week, 21 & 24 November, are the Gann dates for the Nifty 50 Index.

The Nifty 50 Index has strong resistance at the 18400 level. If it breaks and holds above that, then it can trade higher and advance towards 18470/18560/18670/18800.

At the lower end, the Gann support level is at 18200. If the Index holds below that, then it can move lower towards 18130/18040/17930/17800.

Bank Nifty Weekly Gann levels

Next week, 21 & 24 November, are the Bank Nifty Gann dates.

The Bank Index has major resistance at the 42600 level. If it breaks and holds above that, then it can trade higher and advance towards 42800/43100/43500/44100.

At the lower end, the Gann support level is at 41950 level. If the Index holds below that, then it can move lower towards 41750/41450/41050/40550.

Note: The above levels are for educational purposes. Not Buy/Sell advice.