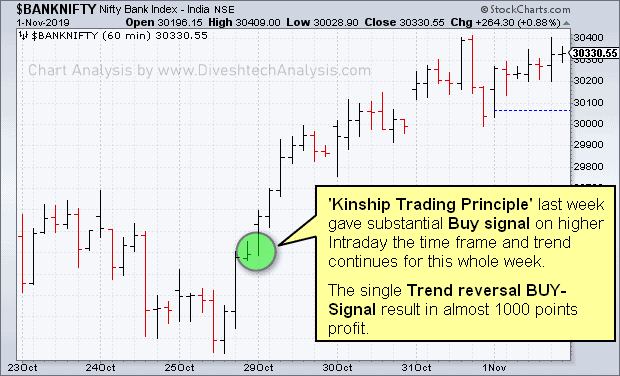

Last week above 29460 Bank Nifty did all the three weekly targets. The Bank Index ended the week with 934 points gain.

In the coming week, Bank Nifty is approaching the critical fixed time cycle period.

In the previous Bank Index continues to trade higher. The opportunity was good to go for long trade for accumulating profits.

When we dive deep into the structures of the markets, the door of a better understanding of the market trend opens up, and it results in great Profit generating opportunities.

Bank Nifty ‘Kinship Trading Principle’ Chart

Bank Nifty ‘Kinship Trading Principle’ Chart

Our ‘Kinship Trading Principle’ technique is one such kind of door. It reveals the market structures as naked truth and helps us to trade well by identifying the significant trend reversal points.

Bank Nifty Weekly Analysis

Bank Nifty Gann Angle Chart

Bank Nifty Gann Angle Chart

After making the low close to one of the critical Gann angle support line Bank Nifty moved up.

In the coming week, Bank Nifty bulls need to trade above 30465 for continuing the on-going momentum.

On the lower end, 29900 will act as critical Support. On holding below that, we may see a dip towards 29600/29200 levels.

In the forthcoming week, 04th & 06th Nov are the critical dates.

Bank Nifty Weekly Trading Levels

Next week 30430 will act as Resistance above which move towards 30580/30830/31250 can seen.

While Support is likely to come at, 30150 below that move towards 30000/29750/29330 can be seen.

Note: Above mention Price projection & other Information are for educational purpose only.