Last week above, 1st Bank Nifty did our 1st weekly target. Then on Tuesday, Index moved below weekly support Pivot and did our 1st target on the downside.

Later in the week, Bank Nifty again moved above weekly resistance Pivot and made the high around 31108. The Bank Index ended the week with 418 points gain.

In the previous week Bank Index showed us the roller coaster moves. The trading moves like such are full of opportunities.

But one can only take advantage of all such moves & opportunities when we know where to expect turn/change in trend in terms of Price by applying the timing rules.

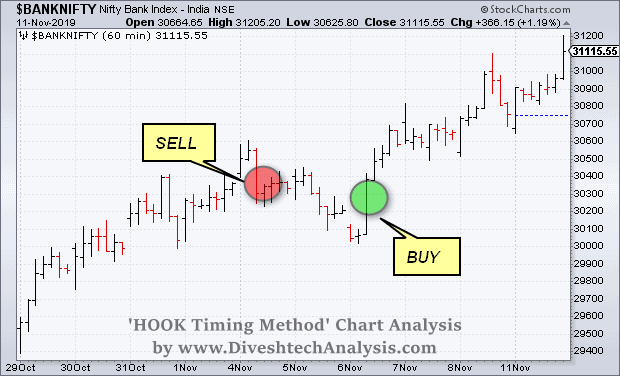

We applied our new Timing trading technique ‘Hook Timing Method’ and grab the successful opportunity of a short and long trade.

Bank Nifty Trading View

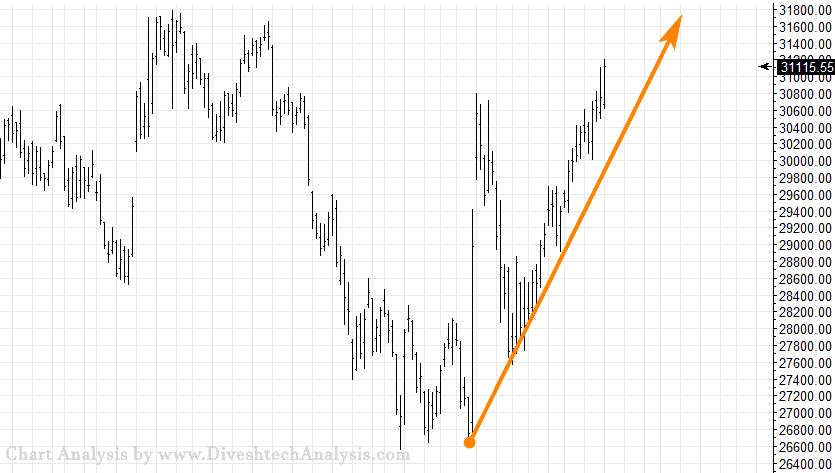

After making the low near to one of the critical Gann angle support line, Bank Nifty continued it’s upside journey like a boss.

In the coming days, Bank Nifty bulls need to trade above 31250 for a further rise towards 31400/31590 levels.

On the upper side, 31590-31627 range will act as a critical resistance area for the bulls.

On the lower end, 30875 will act as critical Support; below that, we may see a dip towards 30600/30400 levels.

In the forthcoming week, 13th Nov is the critical date.

Bank Nifty Weekly Trading Levels

31150 will act as Resistance above which move towards 31300/31600/32100 can seen.

While Support is likely to come at, 30875 below that move towards 30725/30425/29925 can be seen.

Note: Above mention Price projection & other Information are for educational purpose only.